On February 3, 2025 (EST), the U.S. Customs and Border Protection (CBP) announced additional tariffs on imports originating from China (including Hong Kong). These tariffs will be applied to covered imports regardless of their value. Shipments containing such goods will no longer qualify for the “de minimis” administrative exemption from duties and taxes under 19 U.S.C. § 1321(a)(2)(C).

For detailed information, please refer to the following link:

https://content.govdelivery.com/bulletins/gd/USDHSCBP-3d062f4?wgt_ref=USDHSCBP_WIDGET_2

In response to the CBP’s latest policy, YunExpress has issued the following service adjustment announcement. Please read carefully and prepare accordingly.

Policy Effective Date

The above policy will take effect at 12:01 a.m. EST on February 4, 2025.

Key Policy Highlights

1. Elimination of the De Minimis Exemption

The duty-free clearance model, previously applicable to goods valued under $800 (e.g., T86), will no longer apply.

2. Imposition of Additional Tariffs

In addition to the standard tariff rates, the following additional tariffs will apply:

· Section 301 Tariffs (on specified Chinese goods)

· Section 201 and 232 Tariffs (on steel, aluminum, and other products)

· New 10% Tariff (applicable to all goods originating from China, including Hong Kong)

Impact on Cross-Border Sellers and Recommendations

Due to the CBP’s latest policy, customs duties and tax costs will increase significantly, leading to higher overall fulfillment costs for sellers. We recommend you adjust your product pricing based on the actual cost changes.

The new policy imposes more stringent requirements for the accuracy of product data declarations. We recommend you:

· Establish and maintain a comprehensive product declaration database, ensuring the accuracy of information such as HS codes and declaration elements.

· Regularly update product compliance information and stay informed of the latest CBP requirements.

Given the uncertainties surrounding the implementation details of the U.S. Customs policy, delays in parcel clearance are expected. We advise you to plan your shipments in advance and communicate with customers to provide timely reminders.

Instructions for Customer Operations

Due to the CBP’s enhanced supervision of imports from China, please ensure accurate completion of all shipment details, including but not limited to: item name, value, quantity, destination country HS code, weight, etc. The information provided must be truthful, accurate, and complete. YunExpress will submit your declared HS code to U.S. Customs, so please verify its validity.

If you fail to provide an HS code or provide an incomplete one, YunExpress will consider this as authorization to assign an HS code on your behalf. For specific HS code information, refer to the official CBP website.

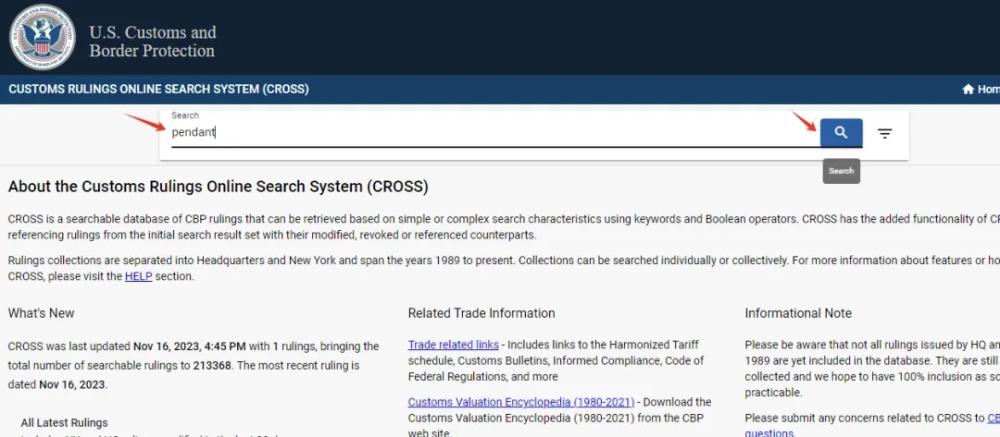

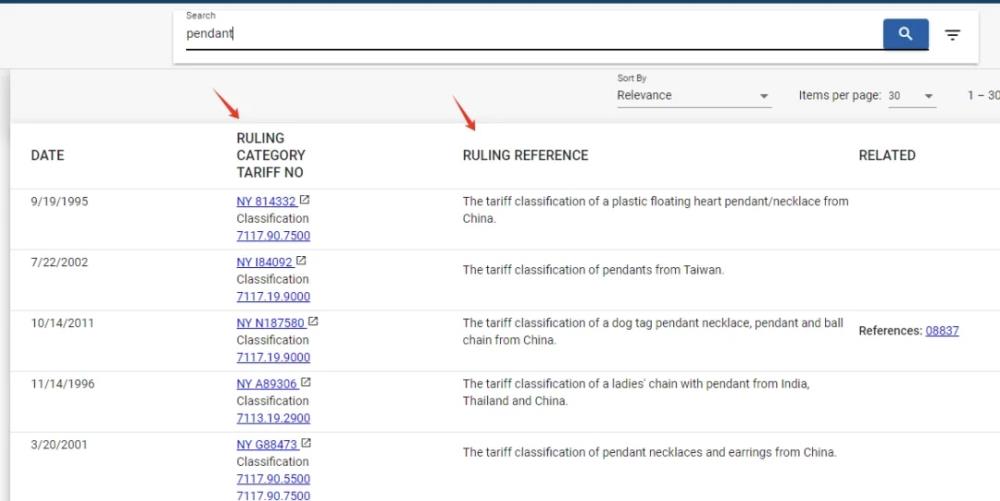

1. Visit the U.S. HS Code query website: https://rulings.cbp.gov/home

2. Enter the English product name and search for the corresponding customs code.

If false declarations result in shipment detention, delays, abandonment, confiscation, or fines, the customer will bear full responsibility and compensate YunExpress for any resulting losses.

YunExpress Fee Adjustments

Due to changes in the import customs clearance model in the destination country and the resulting significant increase in clearance costs, YunExpress will impose an additional customs clearance service fee of 20 RMB per shipment, effective 9:00 a.m. Beijing Time on February 5, 2025.

For shipments originating from China (including Hong Kong) and destined for the U.S., signed in after 9:00 a.m. Beijing Time on February 5, 2025, YunExpress will collect a 30% duty deposit at the time of parcel sign-in. The final amount will align with the actual duties imposed by the CBP, with adjustments made on a “refund for overpayment or supplement for underpayment” basis.

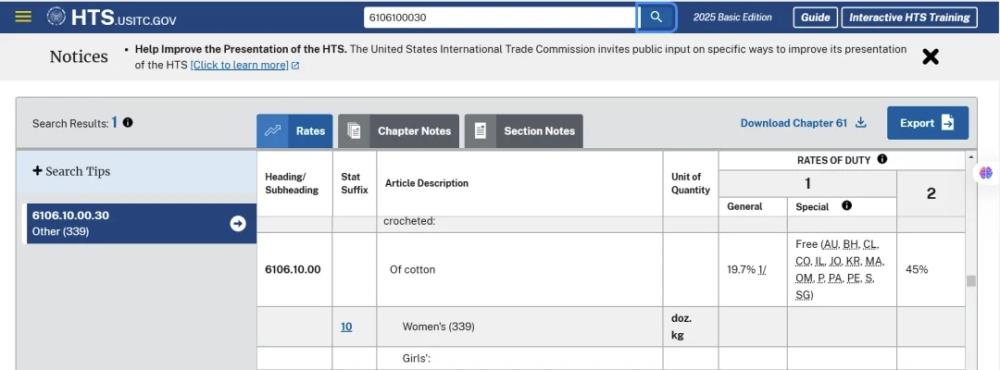

Visit the U.S. tariff rate query website: https://hts.usitc.gov/?query=Hand%20Held%20Massager%20%20No%20Battery%20No%20FDA

Enter the HS code to retrieve the corresponding tariff rates.

Example:

Women’s Woven Trousers – HS Code 6204690310

Base Tariff Rate: 28.6%

Section 301 Additional Duty Rate: 7.5%

Section 201 Additional Duty Rate: 10%

Total Effective Tariff Rate: 46.1%

Emergency Support and Contact

This tariff adjustment will have a significant and far-reaching impact on cross-border business. YunExpress will actively communicate with overseas partners to reduce the policy’s impact as much as possible. We will keep you informed of any updates and recommend adjusting your operational strategies accordingly.

If you have any questions regarding the policy details or YunExpress’s related adjustments, please contact your account manager or customer service for further assistance.

- END -

Contact Information

We encourage all sellers to use the YunExpress shipping channel. For more details, For further information, please reach out to your YunExpress account manager or contact our customer service at helpcare@yunexpress.com.

We place cookies in order to make sure our website works properly and to improve your browsing experience, to streamline and personalize our marketing content and to show you personalized advertisements (including on third party websites). We sometimes share cookie data with our partners for these purposes. Our cookies remember your settings and the data you fill out on forms on our website and analyse traffic to our website. Our cookies also register how you found us and collect information about your browsing habits. You can read more about our use of in our Cookie Notice.